CMB’s Latest Research on Peer-to-peer Payment Trends

About a 2 min. read

A group wedding gift. Snacks at the concession stand. Dinner with friends.

What do these have in common? These are my last 3 Venmo transactions. Just a few years ago, I would have used cash, but now I rarely have cash on hand. This became such a problem, I started a Greenlight account to pay my kids’ allowance. Who needs cash?

With peer-to-peer (P2P) payments, you don’t need to go to the bank or even write a check. P2P payments (also known as money transfer apps) allow users to directly send and receive money faster than ever before—even if you have different banks. CMB’s recent study on P2P payments found that a majority of Americans have used a P2P payment product such as Venmo or PayPal recently – and for Millennials, P2P payment use is as common as using credit cards, which aligns with my experience.

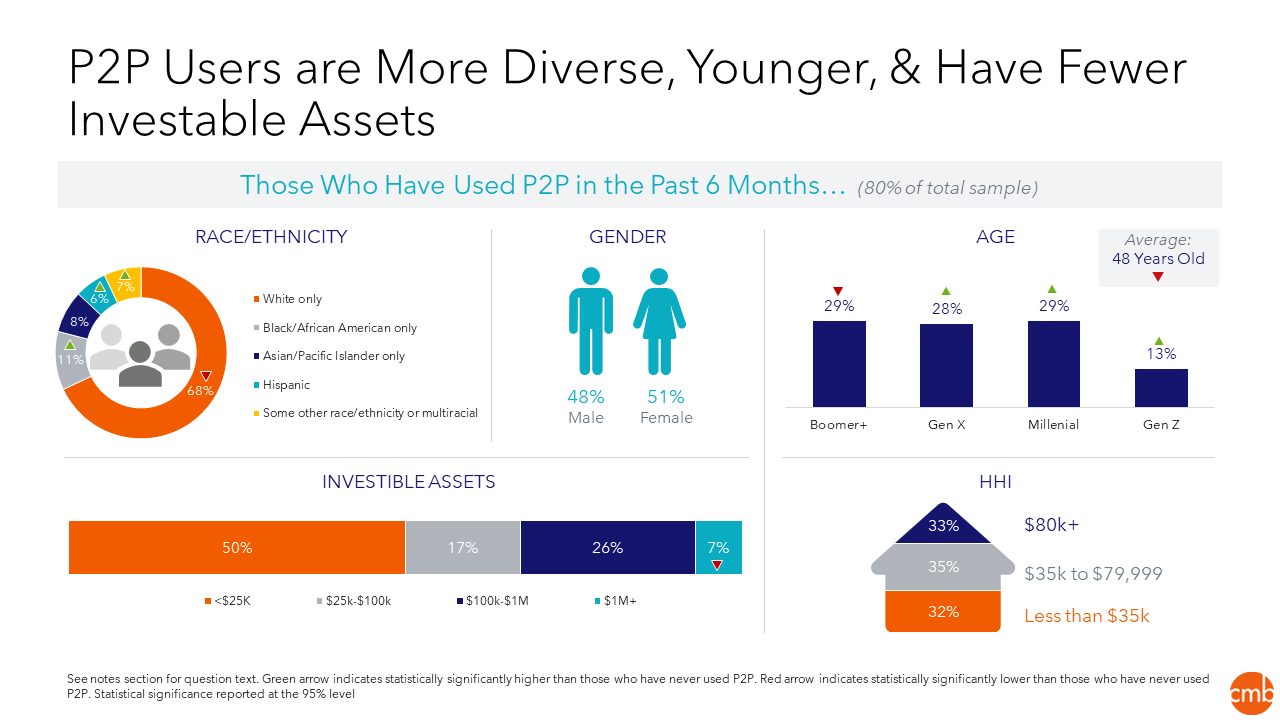

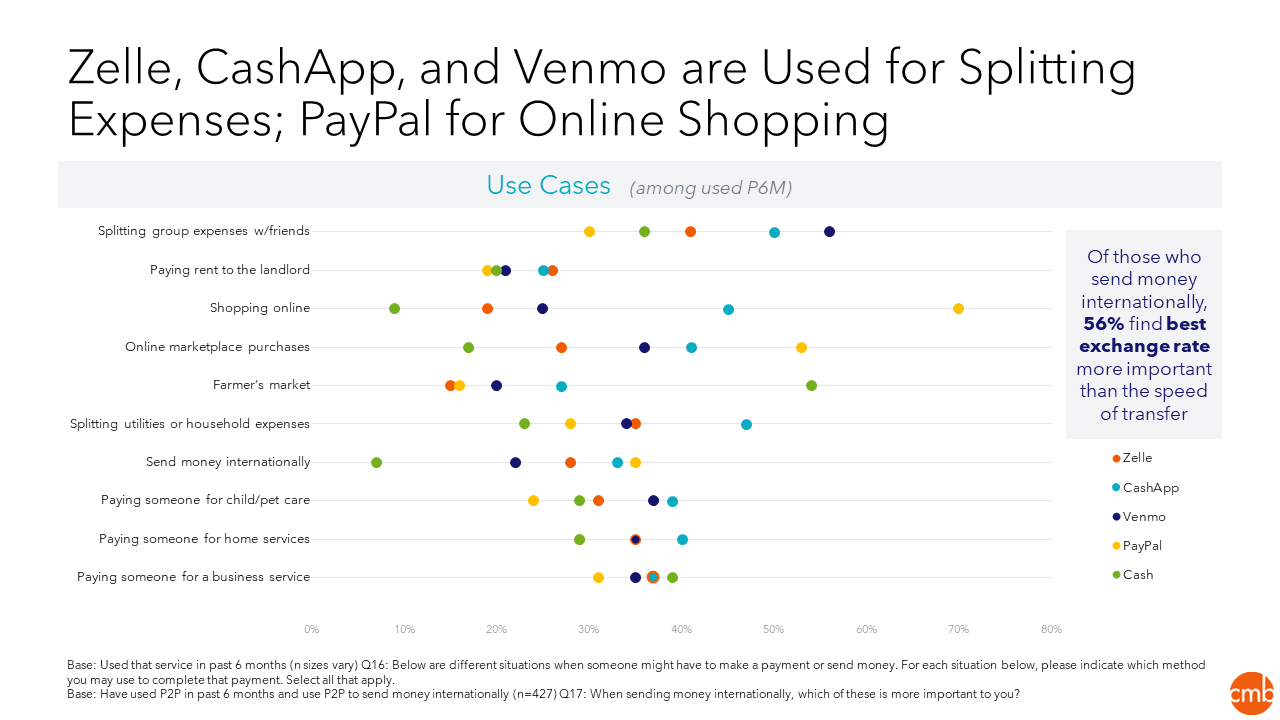

While PayPal is still favored for shopping online, Venmo and CashApp are preferred for splitting group expenses and paying for child or pet care and home services. It’s no surprise that P2P services are more commonly used by the younger generations (the average age of a CashApp user is 38.7). And tracking with this younger demographic, recent P2P app users are more likely to identify as non-white.

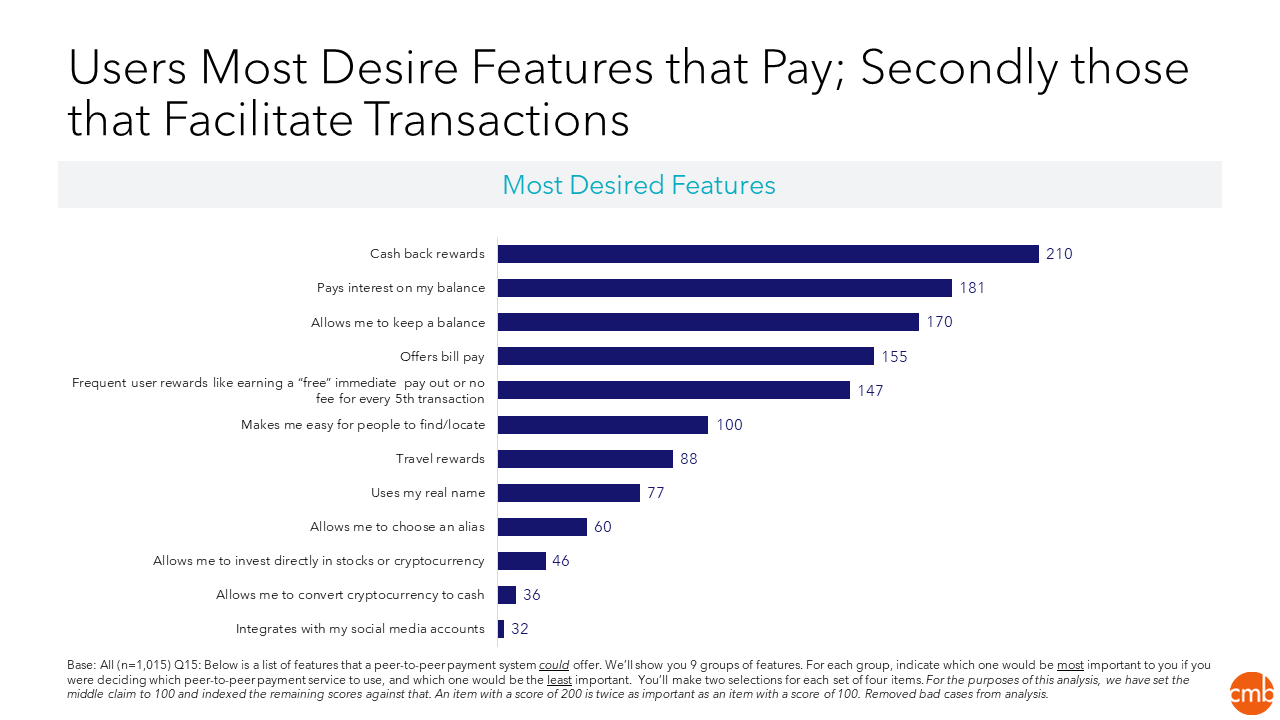

Though these services make transferring funds easy with the click of a button, not everyone is convinced they are secure. It takes time to gain trust in new technology, especially where our bank accounts are concerned. Customers in our study indicate that they trust PayPal most to protect them from fraud, finding it a good choice for paying people they don’t know personally. While gaining trust is key, a little incentive couldn’t hurt either. Customers we spoke with would like to see benefits like cash back and travel rewards – similar to a credit card offers. Applications that allow users to keep a balance and earn interest as with a checking account also have strong appeal, as do bill pay features that allow users to manage all transactions from one account.

Is a cashless society in our future? It’s clear that the rise of P2P and new technologies will continue to impact the way we spend, bank, and save in the future. P2P has already surpassed usage of written bank checks. Will it do the same with cash, debit, and credit cards? How can banks adapt to the changing spending needs of a new, increasingly diverse, and mobile generation? How can retailers adapt to the changing purchasing habits of a new generation? With switching costs between payment methods are low, is there a way to create brand affinity or loyalty? At CMB, our seasoned financial services and technology practice teams are dedicated to helping clients forecast and plan for future trends. From product innovation and research to understanding emotional drivers of usage, our teams are well-versed in delivering the insights that drive future business plans.