CMB’s Latest Research on the Future of BNPL

With recent news that the Buy Now, Pay Later (BNPL) momentum has slowed and brands like Affirm have hit a few speed bumps, it might seem as though the height of BNPL has come and gone—even TikTok is a harbinger of doom. So, what can we make of this? Is the BNPL bloom off the rose?

BNPL-related Google searches are up 9% month over month since December 2022, and even outpacing some credit card brands. While buzz has ebbed and flowed since BNPL’s inception, positive sentiment has far outweighed the negative; Afterpay and Klarna have been the topics of discussion, garnering more searches and conversation than some well-established credit card brands.

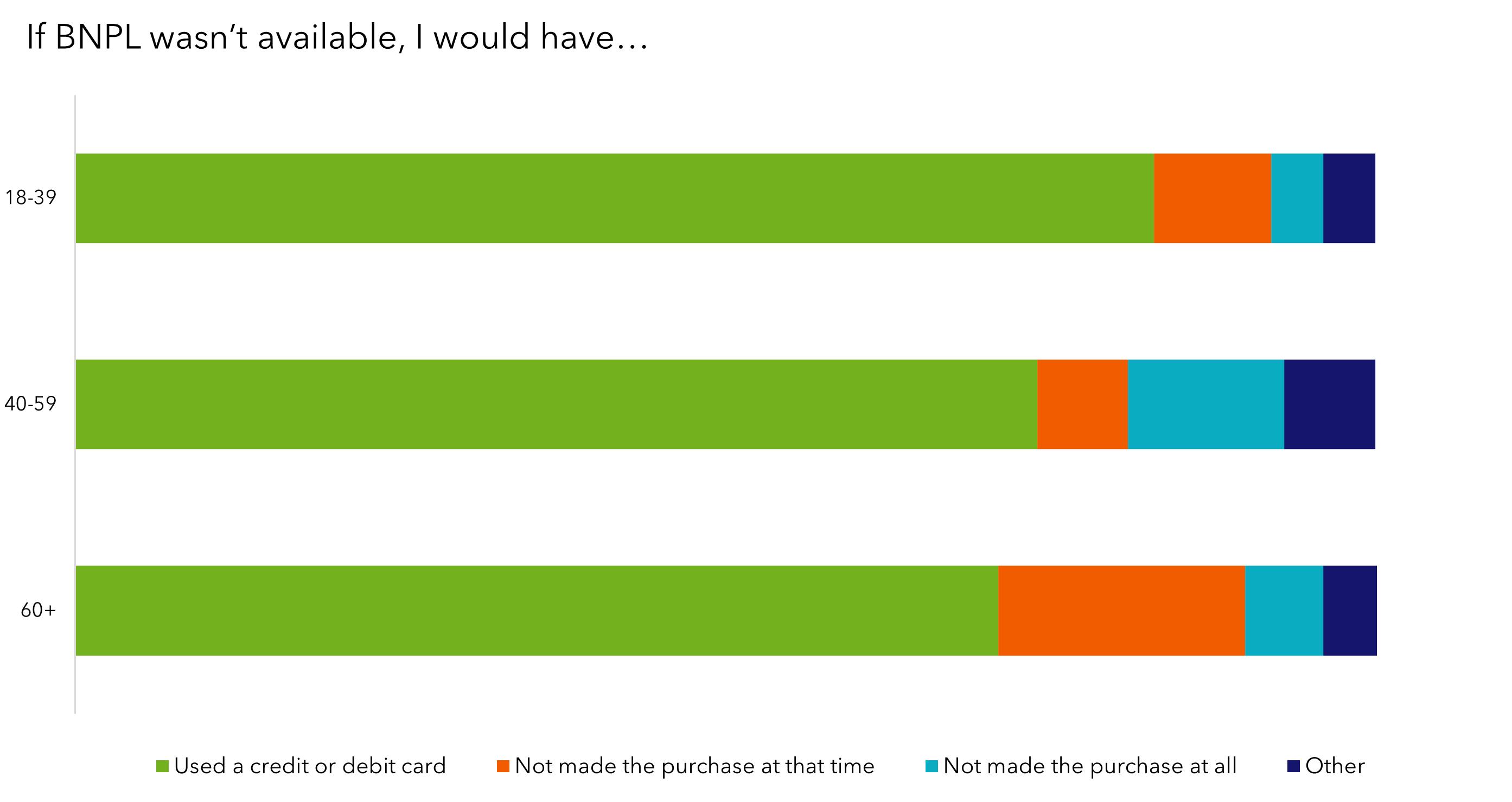

Consumers have embraced BNPL as a legitimate payment option, vying for consumer spending along with credit and debit card options. Recent CMB self-funded research suggests that consumers are happy to swap out a BNPL option for a credit or debit card and vice versa–doing so with very little thought about the difference between the payment methods and what it might mean for them as consumers.

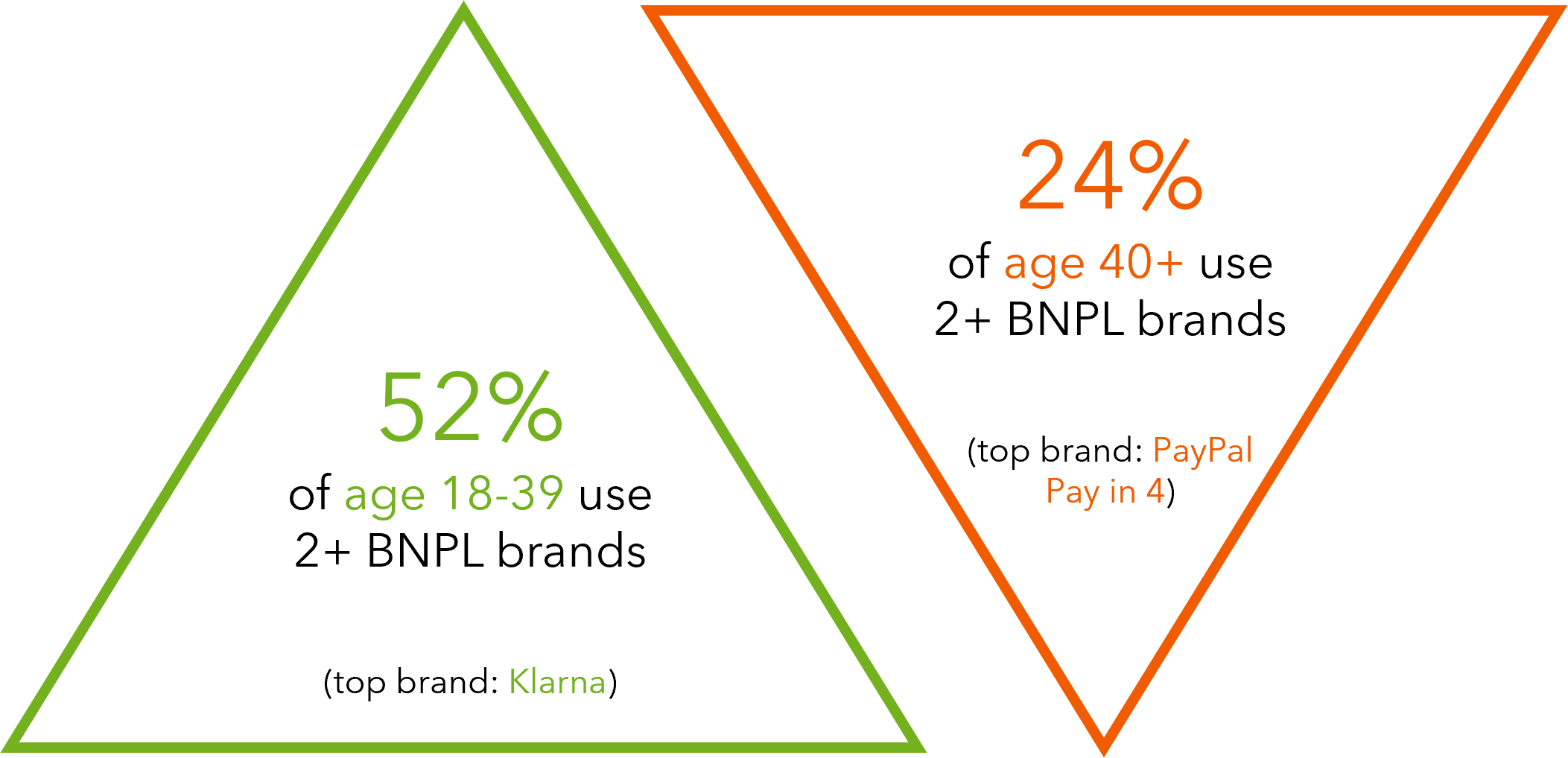

Younger consumers (i.e., Millennials and Gen Z) have adopted BNPL payment options most fully. Though all ages use it, young buyers use more BNPL brands and purchase across more categories using BNPL. They have integrated BNPL into their regular payment options and see the method as interchangeable with debit and credit cards. Younger consumers aren’t using BNPL for only discretionary purchases, but even when they do, they don’t use BNPL as a “last resort” and would not forgo nor even delay their purchase, absent a BNPL payment option.

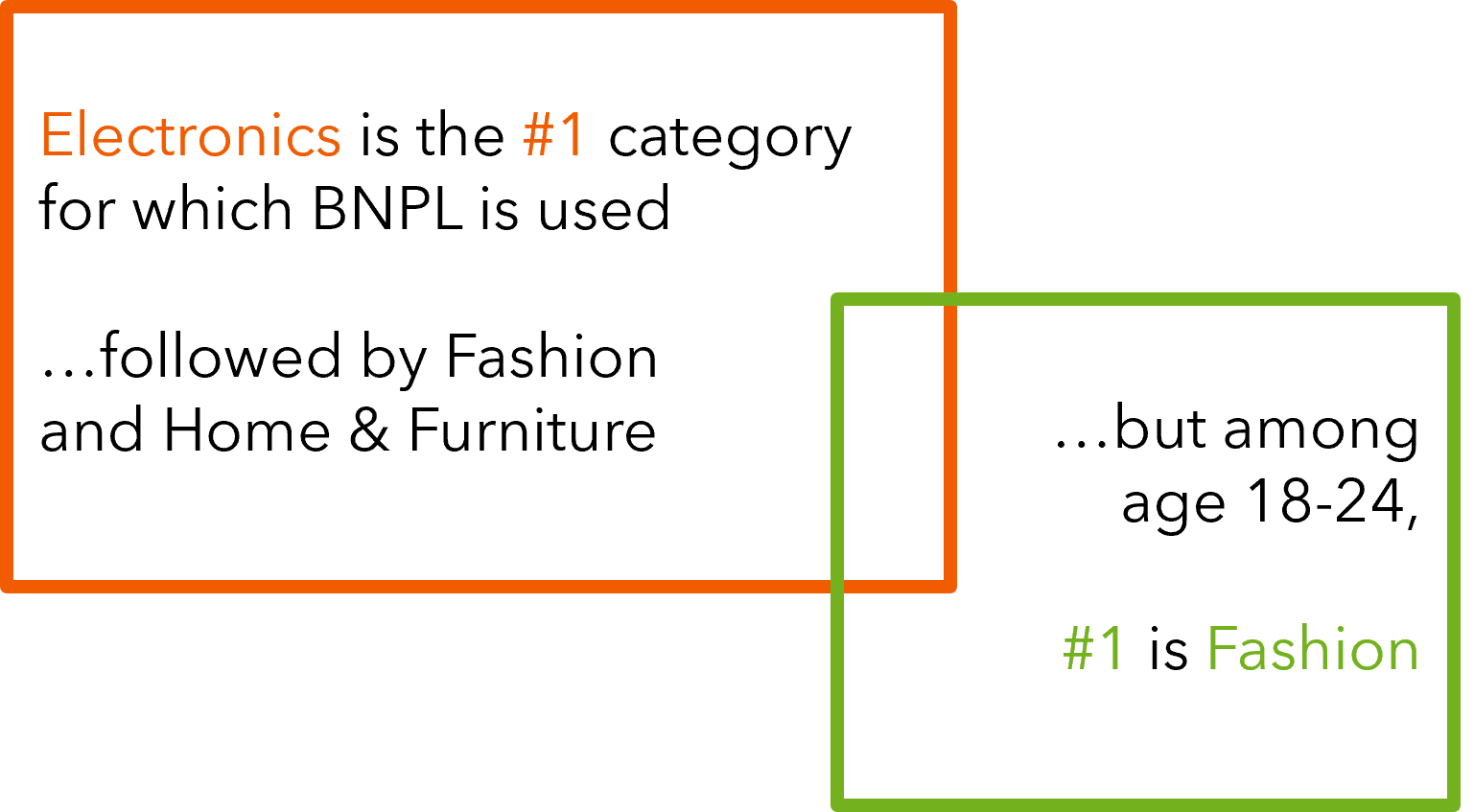

Electronics and fashion top the list of purchases made with BNPL, and for younger consumers, auto joins the top tier while older consumers are more likely to use the payment method for home furnishings. PayPal’s “Pay in 4” and Affirm top the list of brands used, followed closely by Klarna and Afterpay. Affirm is most well-entrenched with electronics, while Afterpay and Klarna are most used for fashion purchases.

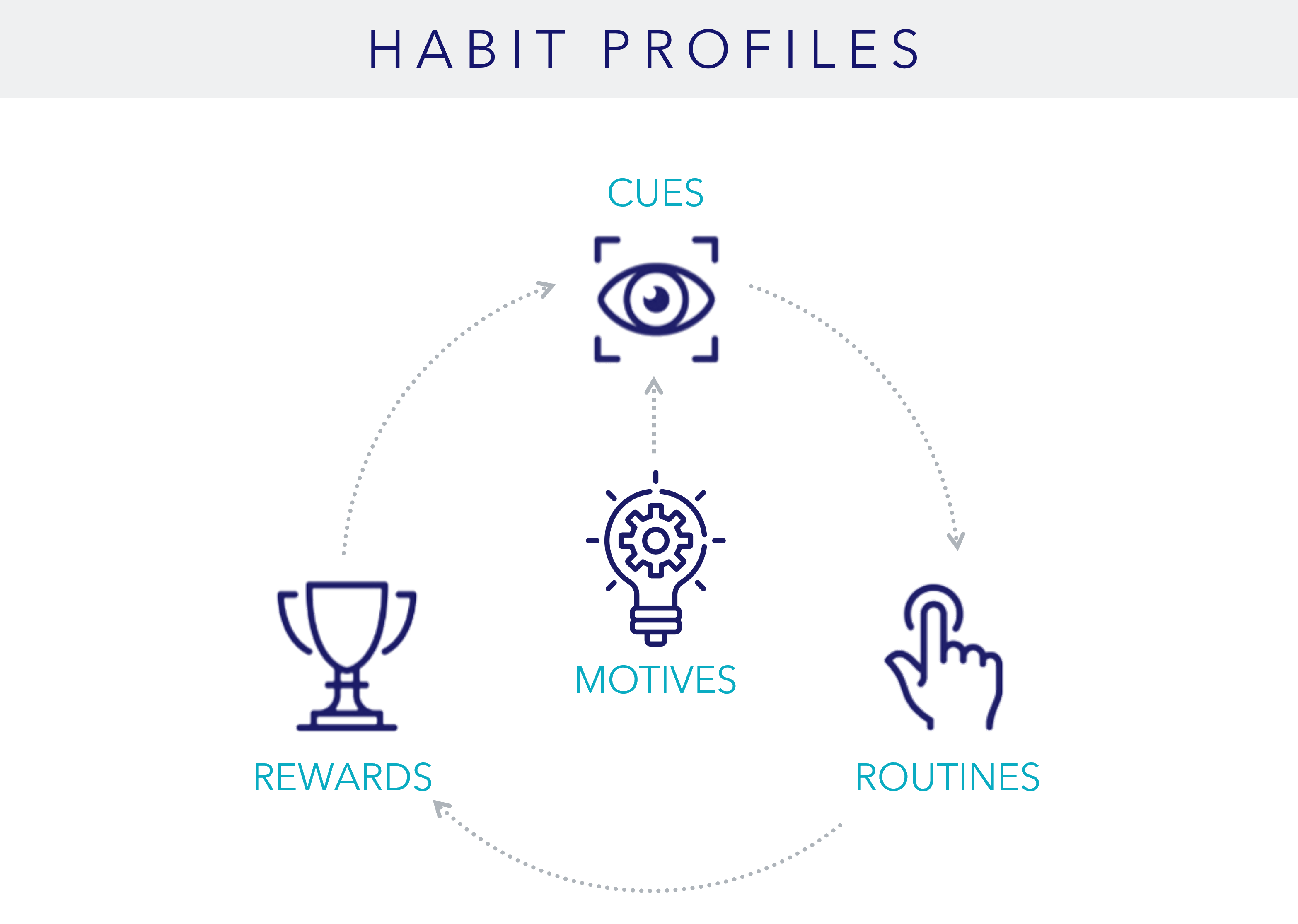

BNPL often disrupts the well-hewn online purchase habit loop by enticing consumers, with cues to buy now and pay later, before a consumer hits the payment screen. A BNPL solution often gets them to make the decision before they need to consciously consider alternative payment methods, which is an excellent example of interrupting a well-entrenched habit (go to payment screen, select card to pay) by influencing one of the inflection points within the payments habit.

So, what are traditional brands to do? Certainly, there will be a shakeout, as more BNPL brands pop onto consumers’ radar, and either succeed or fail, and more card brands launch their own alternative. Brands must consider the entire habit loop for online payments and look for a way to break the newly emerging BNPL routine before it becomes entrenched. CMB’s Habit Loops method uncovers opportunities to trigger habits that support a brand, disrupt habits that don’t, and entrench a brand as part of consumers’ deeply ingrained routines. One thing that cards excel at is offering compelling rewards bundles. Fully understanding the rewards that BNPL offers, both functional and emotional (including the perception of it being “good debt”) and strategizing a way to win, will provide that path to success for card payment methods in the future.

Explore our interactive report on BNPL: The Science Behind the Cognitive Journey.