It’s about a 3 min. read.

Sure, we all love the feels we get staying connected to family and friends, but if you want to feel really good in 2020, log off social media and invest with a financial services firm!

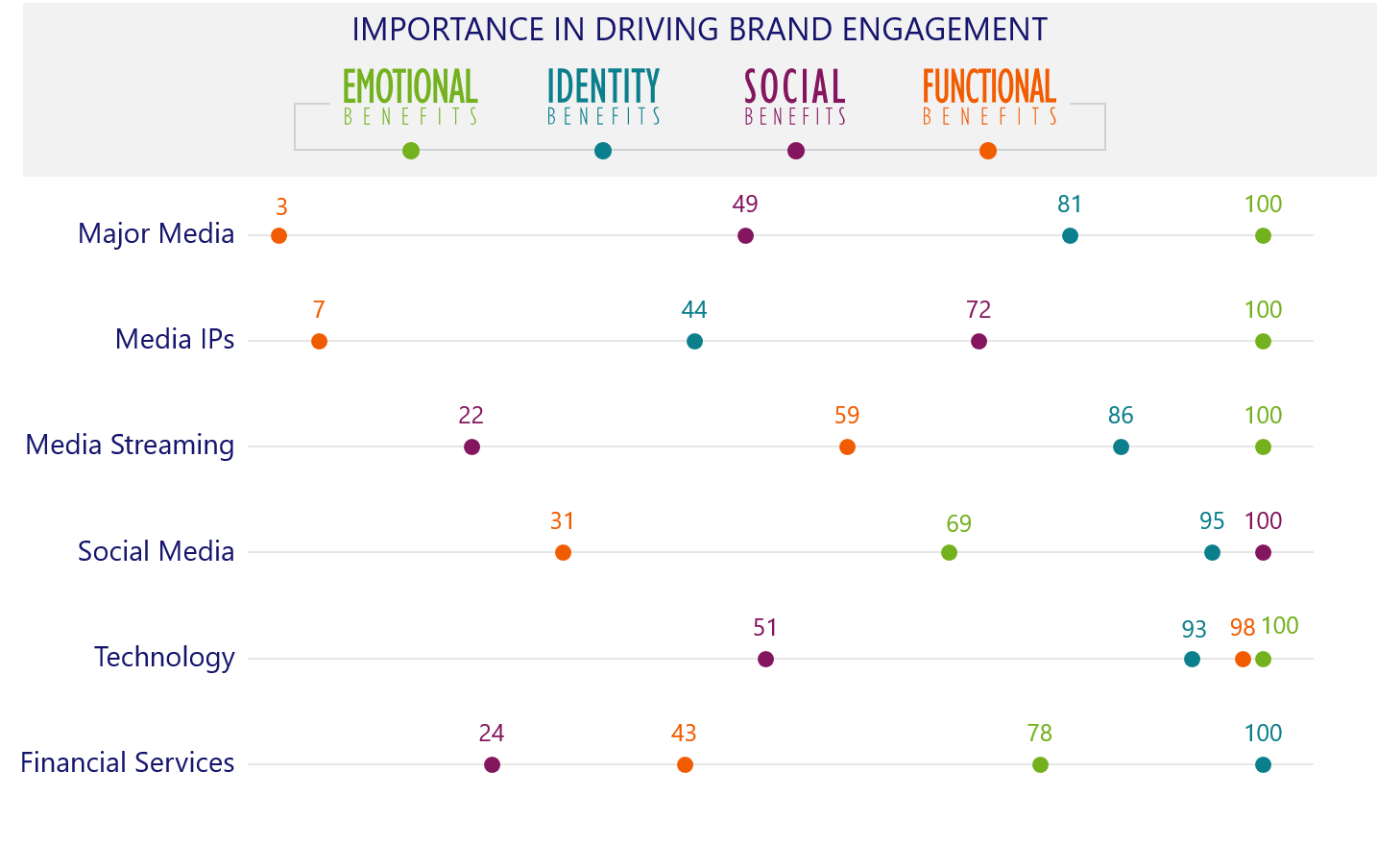

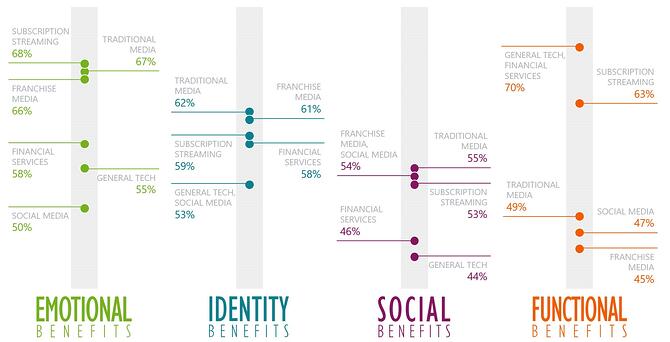

Hold the skepticism and allow me to give a little background. As part of our self-funded Consumer Pulse program, we asked over 20,000 people to evaluate 80 financial services, tech, and media brands on the four key psychological benefits that help people fulfill core motivations: Emotional, Identity, Social, and Functional. Each benefit plays an important role in driving brand consideration, trial, loyalty, and advocacy. Using our proprietary BrandFxSM solution, we can give our clients a complete picture of their brand’s performance versus competitors, the interrelationships between the benefits, and the best path to capturing their target audiences.

So back to those financial services brands. Of course, we expected to see differences between brands within each industry. I was intrigued by an insight that emerged when comparing across industries. Many social media platforms performed far worse on maximizing positive and minimizing negative emotional benefits than financial services brands who, let’s face it, have traditionally been content to focus on functional benefits (e.g. low fees). But investors, competition, and the market are changing, and more, financial service brands are realizing the complex consumer psychology behind brand engagement. Take a look at the powerful consumer-centric messaging from Prudential. It’s important to note that benefits have varying levels of relative importance within different industries, but emotions indeed matter to financial brand customers. They matter a lot!

The truth is, the financial services industry, and investment firms in particular, have done quite a bit in recent years to personalize offerings and humanize their brands through advertising and target-specific messaging, whether they are primarily DIY focused or advisor reliant. At the same time, social media has been plagued by bad PR and concerns over the negative impact on users.

In addition to feeling good, consumers want to enhance their self-image, pride, and self-esteem through the brands they choose. Financial services firms perform better in delivering benefits related to overall identity – personal identity, tribal appeal, relatability–where social media brands perform relatively poorly. Lastly, financial services brands significantly outperform social media on delivering important functional benefits: goals, expectations, time, and money.

If you want to build your brand, keep your customers loyal, and achieve greatness within your industry, you can’t rely on potentially outdated measures like NPS (what is that score really telling you anyway?). Instead, measure the elements that truly drive the behaviors that matter. And in 2020, stop watching cat videos and log onto your investment firm’s website. Check your investments, try some tools, make a few trades and then bask in those positive emotions, feelings of belonging, and sense of accomplishment. It’s going to be a good year.