About a 2 min. read

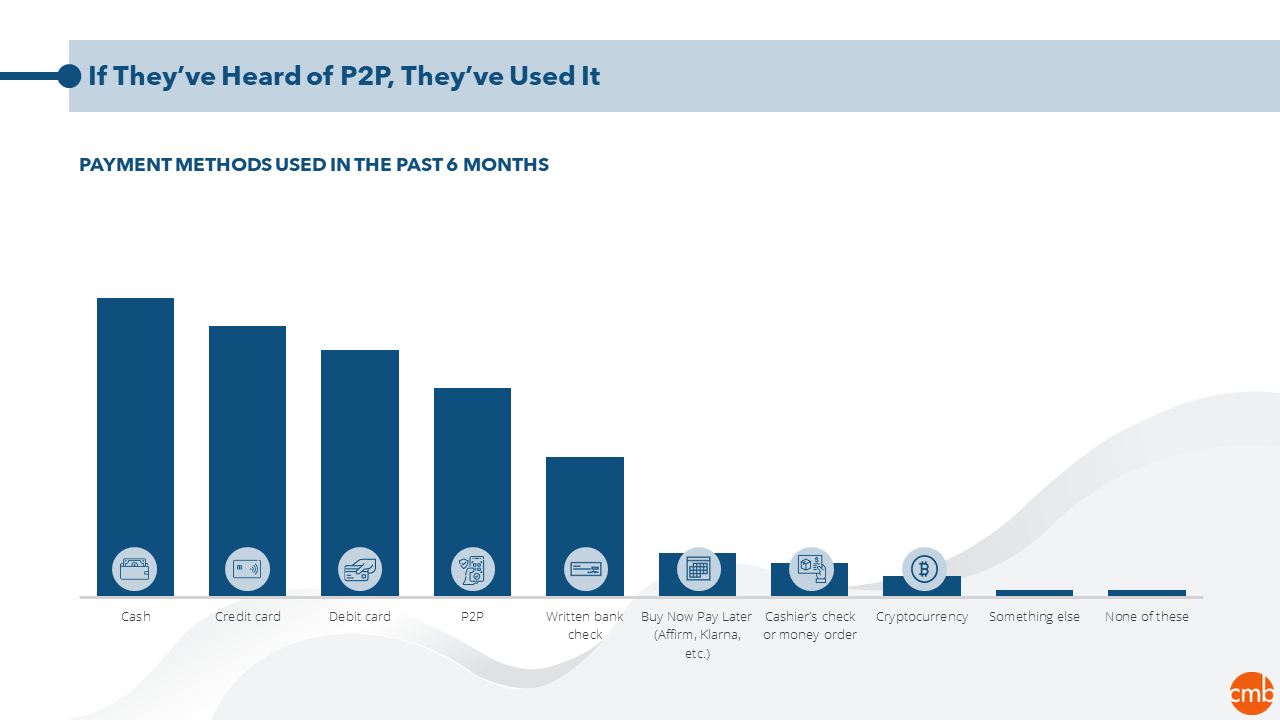

I’ve stopped carrying cash and it hasn’t mattered. Even my neighborhood ice-cream truck accepts Venmo. The days of layaway and exchanging cash are gone in favor of buy-now-pay-later (BNPL) and peer-to-peer payment (P2P) apps. But what’s next?

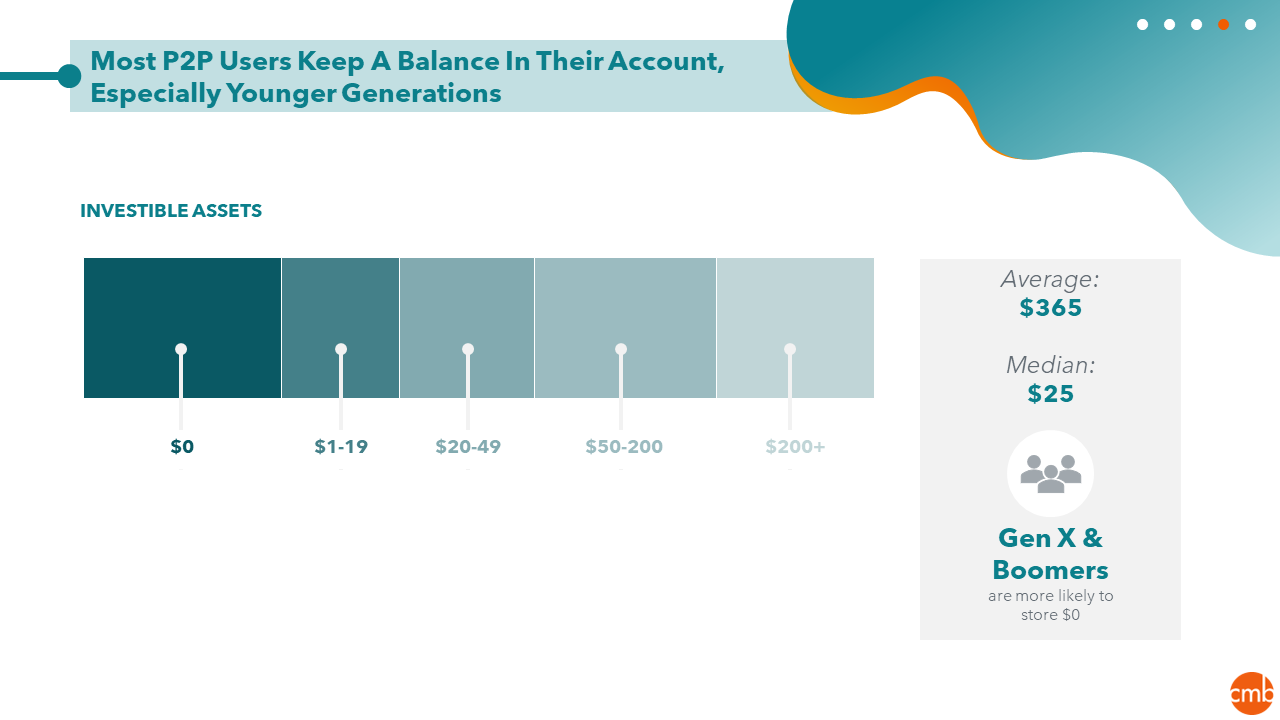

P2P apps have gained massive popularity, especially among Millennials and Gen Z, who enjoy the ease-of-use. Small businesses are drawn to the low fees. But innovation is needed. Individuals store up to $365 on average in their P2P app of choice according to CMB’s latest research. However, that money isn’t federally insured. Small businesses often can’t integrate P2P payments into their existing POS systems. While P2P has revolutionized sharing expenses between friends, the use cases are shockingly limited. The next revolution of payments is needed.

The story of BNPL is similar. It is a massive change from the days of layaway because of the quick access to the product, but innovation is vital. Some are hesitant to use BNPL if they don’t already have the money available due to high late and overdraft fees. For those who have the money already, using a credit card instead is tempting to receive rewards. An innovative combination of the convenience of BNPL with the rewards structure of credit cards could upend the current status quo.

Financial Services is highly competitive, so a company that doesn’t evolve can easily be left in the dust.

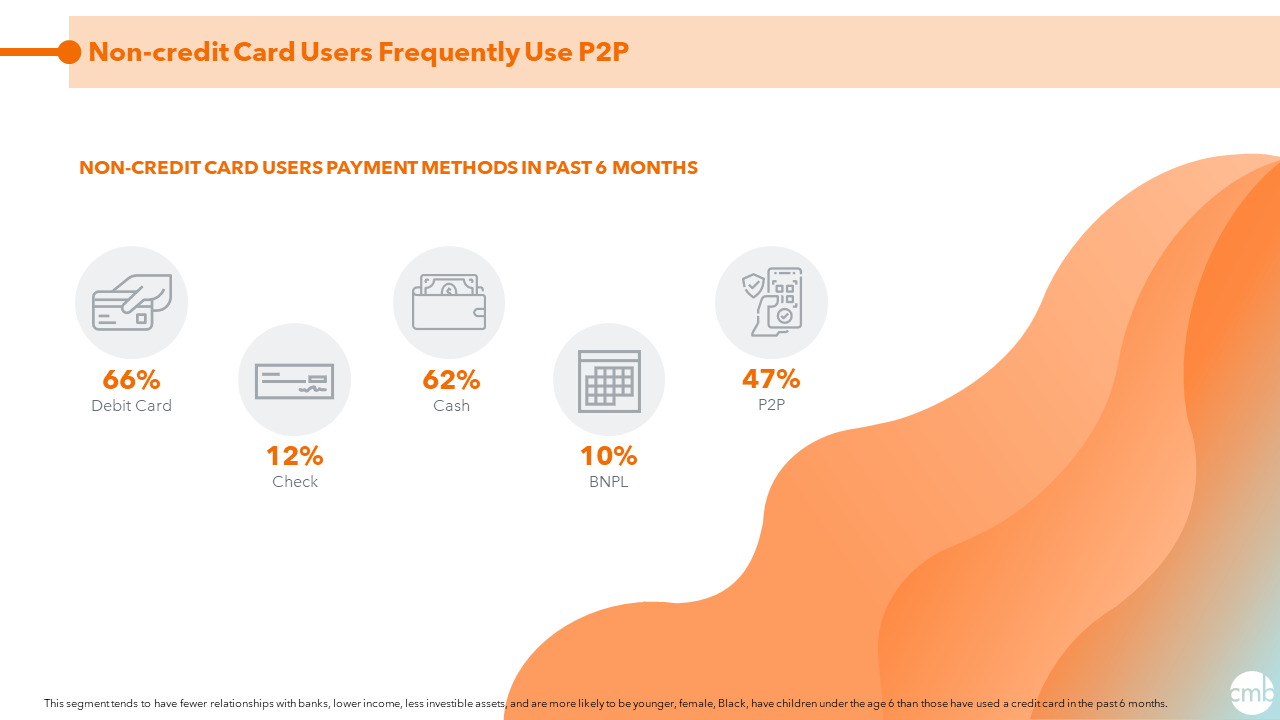

In CMB’s recent study on P2P payments, 47% of people who didn’t use a credit card in the past 6 months used a P2P service, indicating a significant missed opportunity for companies that have not entered the P2P arena. Additionally, a 2022 CNBC article highlighted a consumer question that banks need to watch out for: with all these P2P options available, do you still need a bank? Banks must demonstrate their value by expanding services and innovating to stop the movement away from traditional banks.

For BNPL the threat is clear. As interest rates rise, BNPL companies pay high interest rates on loans used to lend their consumers money for free. As the market fluctuates, so does the viability of these companies, unless they create a way to adjust with the market. Many consumers will not be willing to start paying interest on BNPL loans when it was previously free. Distrust in financial services institutions is already higher than one would hope, so a solution that takes money from the consumer would only deepen that mistrust.

Innovation is needed in all aspects of financial services. There is a long way to go to perfect the tools available, and those who are on the tail-end of that innovation risk falling behind. How do you get started? CMB is a collaborative partner for companies looking to innovate. Our Financial Services team is experienced and excited to help your company rise above the competition and show up for your consumers with confidence. Let’s make an impact.