It's about a 3 min. read.

The leaves are turning, the temps are cooling (I’ve already had the first snowfall of the year), and I’m about to replace the Halloween candy with Holiday cookies! While the shelves are filling with the familiar touchstones of the holidays, for most of us this will be a very different holiday season.

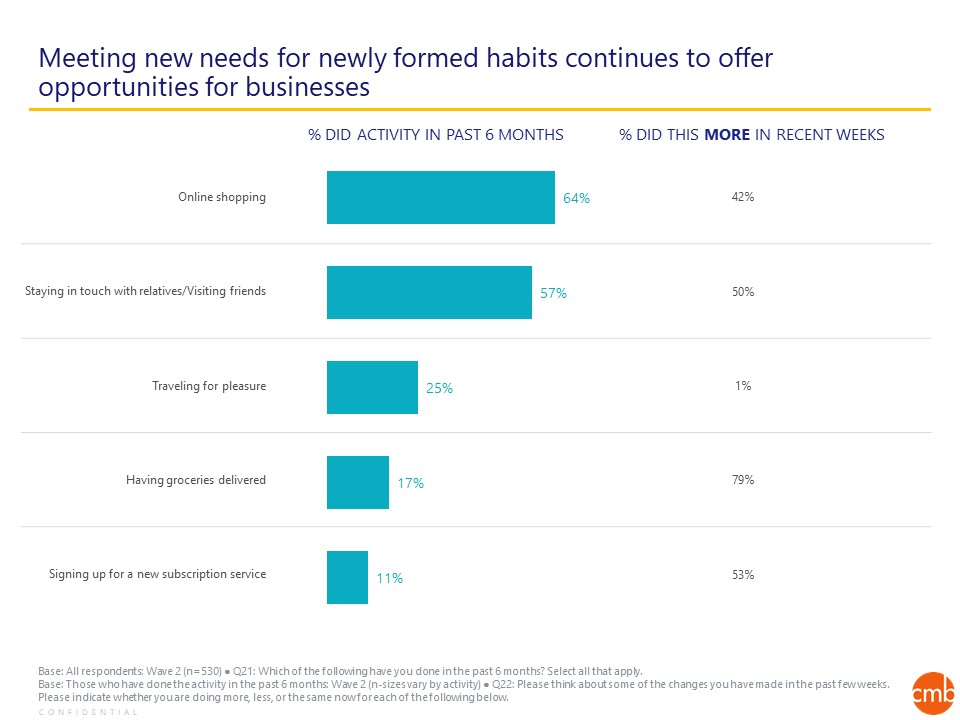

All year we have been watching and analyzing the impact of 2020 on consumer behavior trends. Some changes, born from the pandemic, seem to have some longevity to them – online grocery shopping and delivery, reduced travel, shifting spending habits among credit cards (especially those whose rewards focus on travel), and increased usage in alternative payment methods. With the possibility of another round of shutdowns, household budgets are tighter than ever. The question is, what do these shifts mean for the next few months of consumer behavior?

This holiday season I am most interested in two, closely linked, consumer habits: increased online shopping, and changing payment methods. Way back in April of 2020, CMB looked at consumer sentiment and behaviors related to COVID. Though we were just at the beginning of our new normal, 42% of consumers said they were doing more online shopping and 52% said that they plan to continue this after normal returns. Factoring in anxiety around in-store shopping as we enter prime retail sales time, we should look at how payment methods have changed in 2020.

Like many Americans, since March, I am spending less overall, at different places, and with different payment decision criteria (debit vs. credit and which credit card). For example, in my house, most non-household bills went on the one credit card that gave us airline miles. We love to travel, so this just made sense. Well, I don’t see that trip to Spain happening in the next 8 months, so I evaluated credit cards that provided rewards relevant to my current normal and ended up with a new card…Amazon! Now, this is my go-to card, that replaced my airline card and then some… I am putting everything on it – groceries, cell phone bills, vet bills, etc. I am in the group of consumers that are shifting their top-of-wallet decision criteria and expanding usage to take advantage of rewards that are relevant to me.

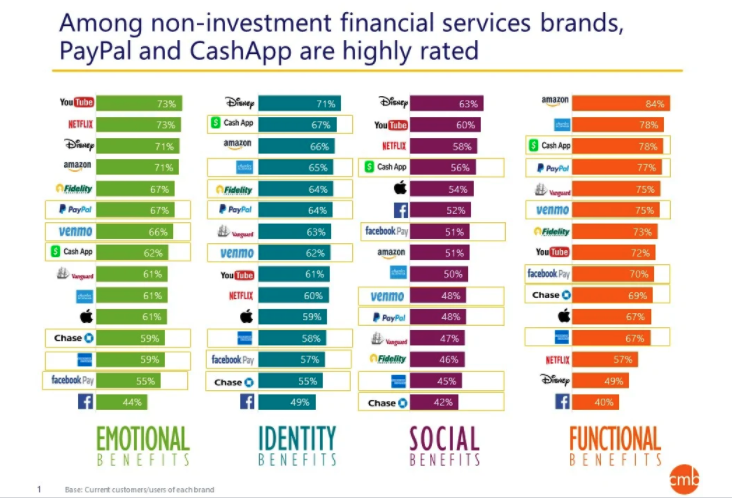

For others (especially Gen Z) who don’t have, use, or want a credit card, we are seeing a shift to alternative payment methods. Our own research from late 2019 showed that PayPal had an advantage over the other brands we tested, but this was before most large credit card issuers introduced their own versions of alternative financing.

We have seen an increase in reported shifts away from credit cards and cash to debit or alternative financing options like Affirm or PayPal – especially among those in the lower household income ranges and younger consumers. The CMB Financial Services team is working with clients to understand what this means for their business, what products they should be marketing, and what, if any, partnerships they should be leveraging. The consumer data is supporting what we all know to be true in our own households – our decision criteria is different now than it was before. The decision of what and when to purchase, but also the decision on how to pay for it.

Now is the time when consumers are making their holiday shopping plans. Now is the time to get the voice of the customer to drive the late Q4 strategy. How are they going to make their gift purchases (or the materials they need for the next great Pinterest inspiration)? How are they going to pay for things? A deep understanding of consumer behavior and motivations will help guide us towards the right questions to ask and create meaningful, pandemic-resistant, consumer-centric business strategies.