It’s about a 7 min. read.

To kick off the Corporate Researchers Conference, a panel of experienced corporate researchers spoke in earnest about what they value in their ultimate research partner. What they value and look for coincides with the “TUFA” strategy that every supplier should practice when building relationships with prospects and clients.

TUFA (them, us, fit, action) is the playbook for real business to business partner relationships that F500 clients yearn for. TUFA involves understanding them (the client/prospect), highlighting what of your research consultancies may be useful to them given their context, demonstrating the business fit between the two companies, then understanding the actions and positive impacts of a successful partnership.

Here’s a summary of what we heard:

- Them. Each of the panelists begged suppliers to please understand their business, products, their goals and direction. Account intelligence is the basic blocking and tackling and it’s important to really understand the client/prospect before attempting to persuade them you’re the right fit. Corporate researchers are inundated with requests for meetings every day and their time is precious. What’s in it for them? For example:

- Kelly Bowie, insights leader at Guardian, said to please know what lines of business Guardian is in before calling on her.

- Amy Basile, Sensory and Consumer Insights Manager at Little Caesars, simply said, “Know my brand and know how to spell it.”

- Us. Corporate researchers schooled suppliers in what they hear from every Gold Top 50 research company: you are a full service, primary market research firm with exceptional execution, advanced analytics, compelling storytelling, and are innovative and global. As the panelists added to the buzzword pile, the audience collectively groaned.

- Colette Thayer from AARP challenged the concept of “full service.” If you’re strong at statistics, modeling and sampling, are you also really excellent at writing? Know your firm’s strengths and highlight appropriately as they relate to your clients’ needs.

- Cole Horton from EA says, “Don’t fake it.” Researchers supporting EA need to fully understand games and need to obsess about gaming themselves. He added, “Don’t overpromise and please be honest if you can’t do something”—citing a time when a supplier wasn’t able to do basic skip logic in the research design but wasn’t upfront about it.

- Fit. Identifying the best fit requires understanding the client/prospects’ business and understanding our own unique value proposition. Some of the corporate researchers believed not much has changed in terms of turnaround times in the last 10 years. Understandably, they want better and faster for less money because they’re being pushed by stakeholders.

- Colette from AARP says it’s a huge risk and time investment for a corporate researcher like her to onboard a new research partner, so she wants proof the marriage will likely endure. For example, she asks to see a sample report or other exemplary evidence the investment is worth her time and resources.

- Amy Basile from Little Caesars said business fit can be as simple as, “Be sure you can connect me to real customers who patron my brand in a cost-efficient way.” She cited challenges that come with panel sourcing, for instance.

- Action is what happens next.

- Kelly from Guardian says that while an insights partner might feel like they’re doing all the work, it’s her team that’s bringing the insights to life at the company. Don’t underestimate that side of the partner equation and the importance of business activation.

- Cole from EA wants research partners to get beyond the basics—to take on a proactive and consultative role and “bring the outside world in.” He acknowledges it’s hard to find and tell a story that is new and actionable, but actionability is the key to moving forward.

There were valuable lessons to be learned from this corporate research panel. Fundamentally, they want research partners (not suppliers) who truly understand their business, can clearly communicate the business fit, and provide an action plan/next steps.

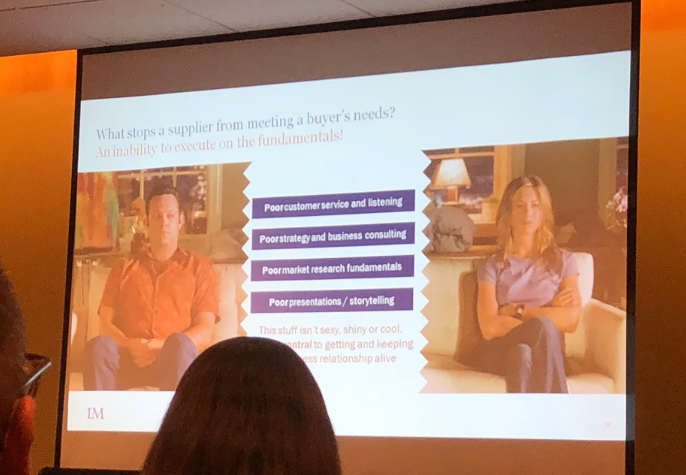

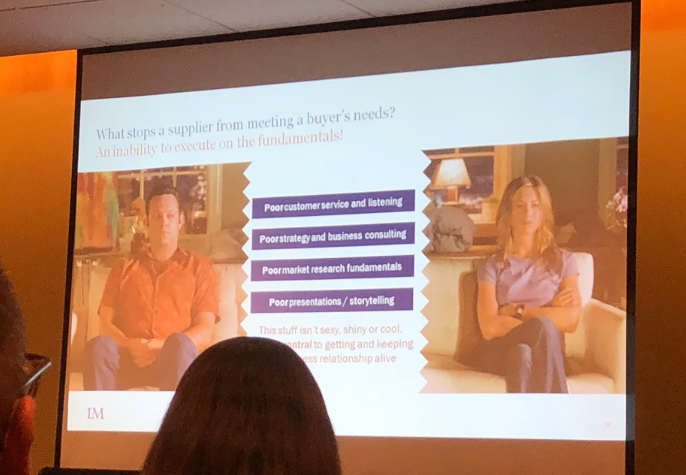

What stops a supplier from meeting a buyer’s needs? An inability to execute on the fundamentals!

For more on TUFA and the approach, please connect with our partners at IMPAX.

Julie Kurd is the VP of Business Development at CMB and will be at TMRE next week in Scottsdale. Connect with her on Twitter or LinkedIn before the conference.