It’s about a 5 min. read.

Think about this…is your “normal” household (i.e. the one you remember from February) going to be changed, in some way shape and form, by what we are going through right now? If your household is like mine, the answer is probably yes. For example, do I think my husband will continue to get excited about making dinner? No. But do I think that the way we shop for food will be different for some time? Absolutely. This got me thinking about incidence and impact…how many consumers are going to be impacted (both foreseeable now and not), and to what degree?

Honestly, I don’t know, which is especially unnerving for someone who gathered consumer sentiment and helped inform business strategies for Toyota Financial Services during the financial crisis and a massive product recall – both impacting millions of people. After the initial shock of those unique situations wore off, we realized that we quickly needed a plan. We needed to know what was going on, what could potentially happen in the future, how does this impact our brand equity, and what do we need to do to come out just as strong, if not stronger. I’m not saying that those two incidents are anything like our current crisis, but I do think that the need for a plan is just as strong. Right now, we don’t know what is next, but that doesn’t mean that we can’t be learning all we can to help our businesses during and after this crisis.

After listening to my colleague Lori Vellucci, VP of Financial Services, and Mack Turner, a Global Insights & Innovation leader, discuss insights from the second wave of our COVID-19 consumer sentiment tracker in “Navigating the Next Normal”, I started to chart out what we need to be looking at (and looking for) to wrap our heads around this.

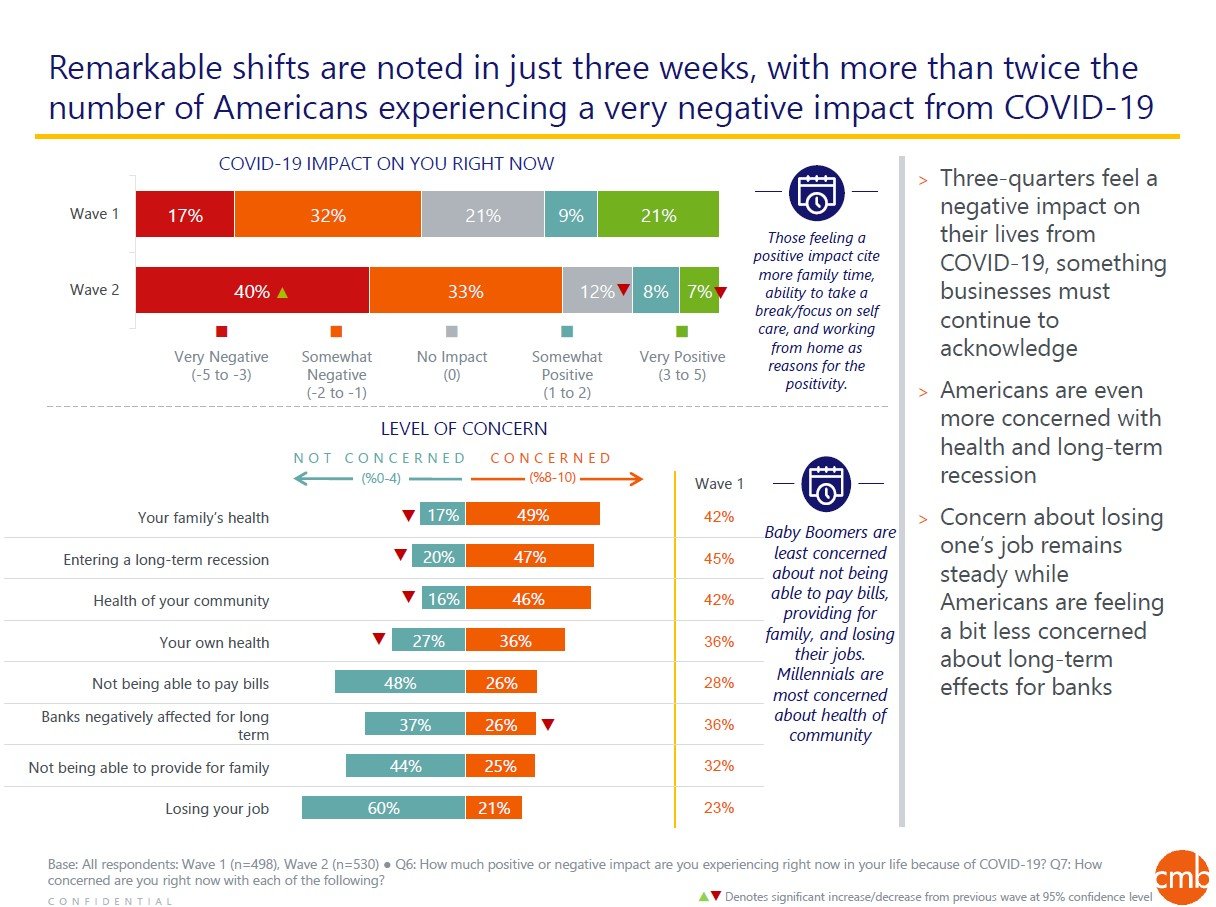

The current crisis is different than any I have been through in large part because of the cause. Health. Global health, health of our communities, and health of individuals. We are inundated with messaging about being in this together and getting through this together. The call for collective values to align is something that will likely impact consumers, to some degree, forever. Our sentiment tracker data shows that in a three-week time period, people express an increased concern for the health of their family and communities, while concerns for their own health is unchanged.

Mack and Lori talked a bit about this data point in the discussion and I agree that this is an indicator that people are thinking more about others than themselves. So, how does this factor into our plans? What do we, as an organization, need to think about (or change) in how we build and communicate our products and services?

To answer those questions, our plan needs to look at how shifts in values impact our brand, products, and/or services. I had a discussion last week with a client that touched on this – when can we include non-COVID messaging in our advertising and communications? How will people perceive us when/if we do? What are the things we need to focus on in future communications? This is not something we can get the answer to immediately – it may be quite some time before we really know the degree to which things have changed. This is where is it important for us to include monitoring of these shifts in our plan and insights.

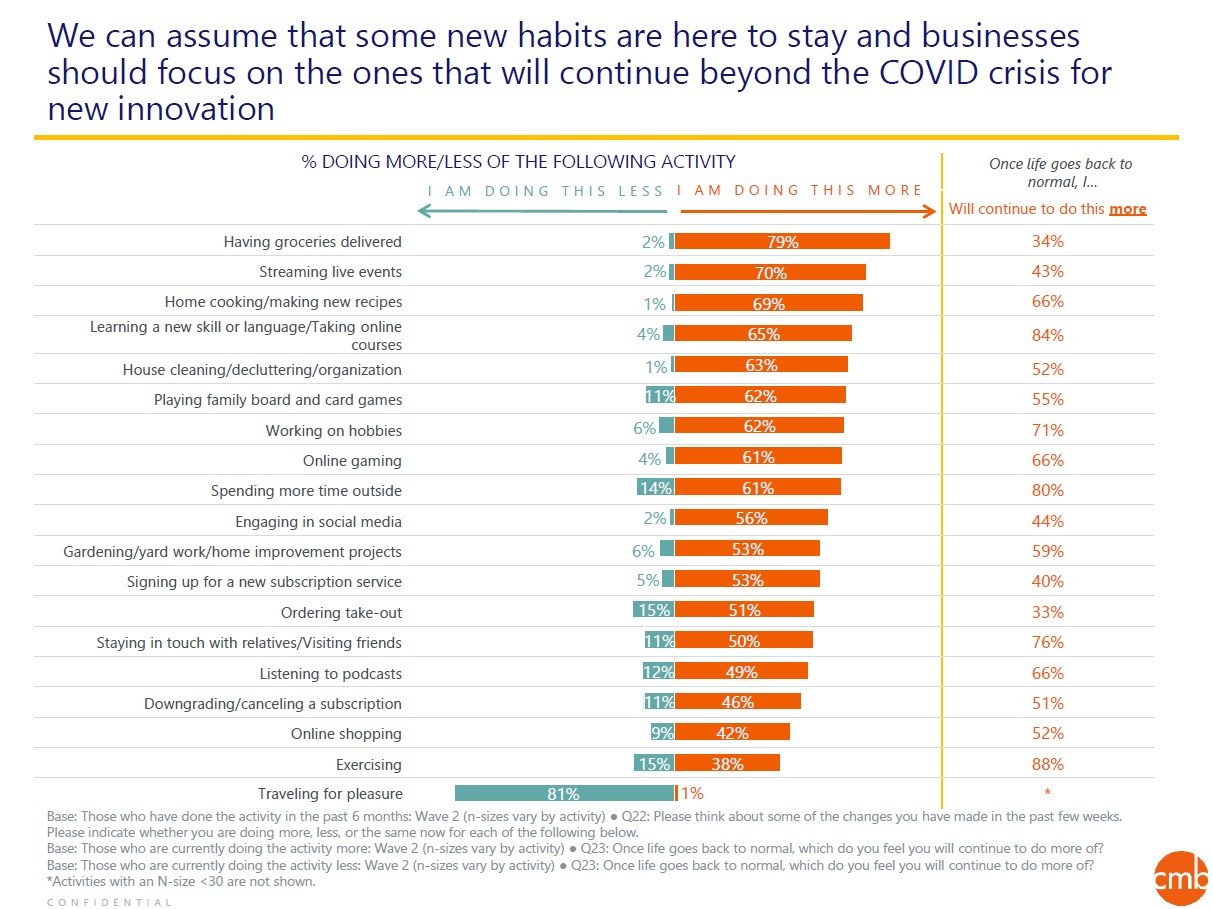

Building off changes in consumer values, our plan should include information on how consumer behaviors changed. If we agree that values, to some degree, will be forever changed then it is safe to believe that behaviors will as well. Said in marketing research terms: how are my customer’s journey and consideration set impacted?

Let’s take the example above about community health. We are already seeing behavioral shifts to demonstrate this through face masks. But, how long and for how many will this continue to be part of their decision process? If I were in the retail or dining industries, I would want to know what behaviors, related to masks, people expect within my establishment.

Another part of the plan would be to understand how things that I “have” to do now may impact how I consider doing things in the future. In the discussion, Lori and Mack talk about grocery delivery, but another related example is online shopping. 42% say they are doing more than before and about half plan to continue to do this more when life goes back to normal.

Many businesses are going to continue being impacted by this global pandemic. Our consumers’ forced behaviors should be part of your plan to deliver on their evolved needs. Consider how your goods/services align with their shifts in values and behaviors; are some of these shifts only temporary? What if they are not?

Mack brings up the example of a shift to online app usage for financial services. These “new” customers to the app may have different needs or expectations from our previous customers. The values and behavioral data informing the plan should provide the business with the information needed to address this. Let’s not forget, though, we will need to understand internal data as well. How does the increase in usage impact other areas of the business (call centers, online agent chats, etc.)?

These are challenging, frustrating, and uncertain times, to be sure. That said, I am looking forward to helping my clients plan for the next normal. Consumer behaviors, psychology, and motivators have always interested me and that is why I went into this field. So…what’s next?